Finance: Wall Street Soars While Main Street Suffers: Meta & Microsoft Post Big Wins, But Who’s Winning Really?

Two of the biggest tech titans in America just dropped financial bombshells that sent Wall Street into celebration mode—Meta and Microsoft both blew past earnings expectations, igniting a surge in stock futures and calming investor fears of a looming recession.

Meta reported a jaw-dropping $47.52 billion in revenue for Q2, crushing analyst estimates of $44.8 billion. The result sent its stock skyrocketing 10% in after-hours trading. Meanwhile, Microsoft wasn’t far behind, posting $76.44 billion in quarterly revenue, up 18% year-over-year, and beating Wall Street’s forecast of $73.81 billion. Microsoft shares rose 7% following the announcement.

The earnings glow came alongside stronger-than-expected GDP numbers. America’s economy grew by 3% between April and June, significantly outperforming the 2.3% estimate. A dip in imports, slight export declines, and modest increases in consumer spending helped fuel the positive outlook.

With that, analysts claimed recession worries may be fading—but for millions of working-class Americans, this economic “win” feels more like smoke and mirrors.

MainEvent.News | Backstage Take

The headlines shout prosperity, but let’s talk about reality for everyday Americans:

✔️ Rent is at record highs, forcing families to downsize or face eviction.

✔️ Grocery bills have ballooned, with basics like eggs, milk, and bread costing double what they did just a few years ago.

✔️ Utility bills for gas and electricity are gouging households, even in mild seasons.

✔️ Fast food, once a cheap family dinner option, now rivals dine-in prices—making it unaffordable for many.

✔️ And while the unemployment rate appears “low,” that number doesn’t include the millions who’ve exhausted their benefits or simply stopped looking for work, disillusioned by low pay and high costs.

Yes, Meta and Microsoft are thriving. But if you’re not holding shares or working in tech, you’re likely not seeing the upside. The disconnect between stock market euphoria and real-life economic struggle has never been more glaring.

As President Trump continues to pressure the Fed to cut interest rates, many Americans are just hoping to refinance their mortgages or afford next month’s energy bill.

The Federal Reserve, for its part, chose to hold interest rates steady in July, citing “moderated” growth and still-elevated inflation.

So while Wall Street celebrates, the rest of America watches from the sidelines—wondering when that prosperity will finally trickle down.

BuzzLine Headlines

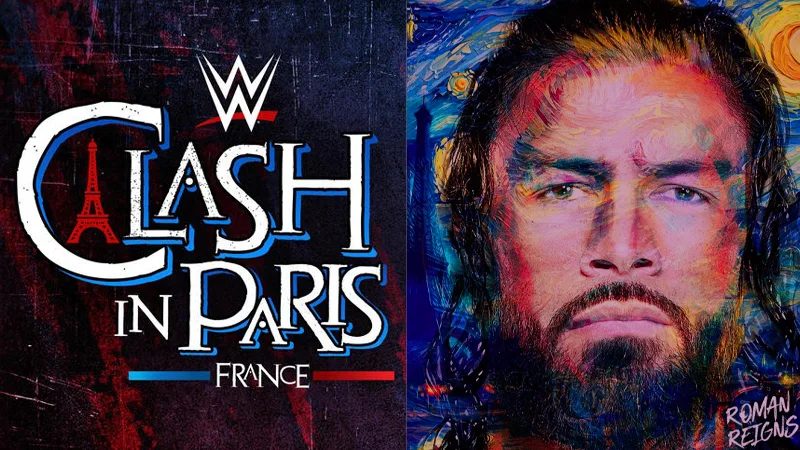

Wrestling: Roman Reigns Confirmed for WWE Clash in Paris Before Heading to Hollywood

BuzzLine News: Who is Tyler Robinson? The Man Identified as Charlie Kirk’s Killer; Admits to Shooting in Chilling Confession

BuzzLine News: Video Confirms Charlie Kirk Shot in the Neck During Utah Valley University Event — Condition Still Unknown — Eyewitness Claims Shooter Yelled “I’d Do It Again”